Your Enthusiasm Will Make A Difference

posted from https://addicted2success.com/life/your-enthusiasm-will-make-a-difference/

I have read Dr. Peale’s book “Enthusiasm Make The Difference.” As a matter of fact, I have read a few of his books. All of them are good reads. I love the examples and stories of his patients and clients in a world so far different than ours today. The stories are pre-internet days. Pre-everything days really. Some say it was much simpler then, than now. To a certain extent, I agree with those people. Life has sped up.

I remember my younger days with the long phone chords stretching them as far as possible to get some privacy and the big box televisions that weighed a gazillion pounds. Atari, Betamax VCR’s, eight-tracks, cassette tapes, and so many other obsolete devices we all used that no longer exist. It’s funny, those things are gone with new improved and faster technology, but the wisdom of Dr. Peale remains the same. It’s true, enthusiasm does make the difference. It was the same as in 1967 when his book was published and now in 2019. If you want people to listen to you, follow you, or learn from you, you need enthusiasm.

Enthusiasm matters

Each semester I begin all my classes doing push-ups the first day. The students come in with regular street clothes expecting to hear the usual “spiel” on the class requirements, paperwork, and the expectations for the course. Now, remember, I teach kids how to lift weights, not math or science. Following the discussion of general information, I tell them to get in a big circle in the weight room.

I teach them how to do a correct push-up and demonstrate key points to make it more safe and effective. Then, we do a lot of push-ups. I am usually met with some resistance with a few of the students. While they all elected to take the class (it is not required- but should be), they are not too keen on doing push-ups in their blue jeans or their “school clothes.” Almost 100% of the time, the students finish loving the activity. They laugh and have fun with it. Why? I make it fun for them. I am loud. I talk fast. I make jokes (they are funny to me, probably not to them).

I do the push-ups with them. I am enthusiastic about the experience! If I went into the activity with typical teacher talk, I would not get the same effect. Furthermore, if I went into it being a drill sergeant and demanded it from them, I would be met with a ton of resistance as well. I start each class and each semester with push-ups for a few reasons. I want to let them know the course will be challenging. I want to show them that you do not need a long drawn out routine for exercise to be effective. And, mostly to show them that physical training can be a fun and enjoyable experience.

“Nothing great was ever achieved without enthusiasm.” – Ralph Waldo Emerson

When I coach wrestling, I might not smile as much, at least in the beginning, but I make it a priority to be enthusiastic each day. I talk to my team a lot about the proper mindset they need to have each day to have a good practice and to get the most out of the workout. I tell them that it will be tough and needs to be tough because from that we get better, and we will shorten the learning curve with other teams that have more experience.

I participate in most conditioning workouts with them. I want to share the experience with them. By doing that, I build trust and rapport. Ultimately though, what matters most is that each day I (and my other coaches) are enthusiastic in what we do.

Enthusiasm is the “secret sauce” in nearly every life activity. Whether it is mowing the lawn or working out, having energy and spirit make any challenging experience better. Enthusiasm also brings out the best in others!

How to develop enthusiasm

Let’s be clear before I discuss ways to develop enthusiasm with your team or daily life, it isn’t Pollyanna double-speak and painting a rosy picture to your students, organization, or employment staff. Enthusiasm is bringing passion and love into an experience and doing it with energy and vitality. It is selling your people to buy into your program, and it is showing up prepared and ready to attack what’s ahead of you. It is not getting through it and surviving.

How can we develop an enthusiastic attitude? It first begins in your own mind! Everything we do starts in our minds. To be passionate, you need to plant the seeds of enthusiasm into your thinking. You need to tell yourself that it’s going to be a great experience and your day is going to be filled with opportunities!

You tell yourself you are “lucky” to have the chance to do whatever you do. What if you do not feel that way? Well, you lie to yourself. You keep telling yourself that it is going to be good. You catch the negative thinking right away and quickly change it to something that will benefit and motivate you.

In what ways can we demonstrate enthusiasm with others? The biggest thing that will show your enthusiasm is your body language, tone of your voice, and facial expressions. In other words, your physiology. If you want people to be enthusiastic, you demonstrate it first. You talk louder. You move faster. Equally important, you smile and have some fun in what you are doing.

And if you don’t feel that way when you start, fake it, do it anyway, and I guarantee you will quickly morph into the person you are trying to be. You will get excited and feel full of energy. You “trick” yourself into being enthusiastic and low and behold after a couple of minutes, you are!

“Enthusiasm releases the drive to carry you over obstacles and adds significance to all you do.” – Norman Vincent Peale

So remember, enthusiasm starts in your own thinking. If you think lazy and uninspiring thoughts, the result will be that you are lazy and uninspired in your daily living and communication with people. You need to change your thinking deliberately. At first, it will need to be repetitive and constant. Eventually, it only takes a quick reframe of your negative thought to turn it into a positive one. But like anything else in life that’s worth it, it takes time and effort.

You also have to move your body like a person who has enthusiasm. “Fake it till you make it.” If you move your body intending to be enthusiastic, your mind will follow.

TransferWise Review: A Better Way to Conduct Foreign Exchange?

posted from http://feedproxy.google.com/~r/mrsjanuary/~3/mvVwriCZdGY/

The high fees and bloated exchange rates incurred when sending and receiving foreign currency can be a bitter pill to swallow. This is especially true for anyone who has to send money abroad on a regular basis. Much of the problem lies in the exchange rates offered by banks, which are priced well above the actual market exchange rate. Not only that, fees on wire transfers can be as high as $50 or more, depending on the amount of money you’re sending.

Recently, I wrote an article on the various ways that you can exchange money, so I thought the timing was right for a review of TransferWise, a leader in online foreign currency exchange. Thankfully, companies like TransferWise are around, to take the sting out of foreign exchange, as well as sending money overseas.

Using the latest in mobile technology, TransferWise makes foreign exchange instant, and affordable. In this TransferWise Canada review, I’ll show you exactly how TransferWise works to save you money, and why it’s a better way to send money than through traditional channels ie. your local bank branch.

What Is TransferWise?

TransferWise is a U.K. based company, founded in 2010, by two friends, Kristo Käärmann and Taavet Hinrikus. Fast forward to today, TransferWise is now worth more than $1 billion and boasts more than 6 million customers.

According to Business Insider, “the idea for TransferWise surfaced when its two founders realized that they could cut down on money-transfer costs by paying each other’s expenses. Hinrikus used his money in Estonia to pay for Käärmann’s mortgage, and Käärmann used his money in the UK to send payment to Hinrikus. TransferWise avoids international bank-transfer fees by keeping the money transfers inside the country, using domestic accounts to minimize the distance that money has to travel.”

How to Save Money with TransferWise

TransferWise saves you money in three ways. For starters, all foreign exchange is conducted using mid-market exchange rate, or real exchange rate. This is the rate without the spread that’s added by your bank or broker, which means you’re getting the lowest possible rate of exchange, regardless of the amount of currency.

While TransferWise does charge a nominal fee to send money, it’s typically under 1%. Compare that to the 2.5% foreign exchange fee whenever you make a foreign currency purchase with your credit card. Or, the high fees charged by your bank when you send funds via wire transfer, which can be upwards of $100, depending on the amount you are sending. I should point out that it’s free to receive funds into your TransferWise account. With bank wire transfers, recipients are usually charged a fee when the funds arrive in their account.

Lastly, you will pay a fee when you make your payment to TransferWise, to fund your transaction. However, these charges are fairly minimal, especially when you send money via direct debit from your bank account.

What Is a Mid-Market Exchange Rate?

The mid-market rate represents the midpoint, between two currencies buy and sell prices. TransferWise always charges the mid-market exchange rate, whereas your bank will include a spread on the rate the client pays, in order to boost profits on an exchange transaction. Fees aside, this is why you’ll save money sending money through TransferWise, as opposed to say, a bank to bank wire transfer. The mid-market rate is considered the most accurate rate of exchange between two currencies.

What Countries Can I Send Money To?

TransferWise has the ability to send money to most major countries and currencies. I counted no less than 58 countries on the TransferWise website. I’ve listed just a few of those below. I should note that there are restrictions on some currencies, in how transfers can be sent and received. It’s important to read the instructions as they pertain to the specific country you are wanting to send funds to.

- Australia

- Brazil

- Canada

- China

- Columbia

- Denmark

- India

- Indonesia

- Israel

- Japan

- Mexico

- Norway

- Philippines

- South Africa

- South Korea

- Thailand

- Turkey

- United Arab Emirates

- United States

- Vietnam

How to Send Money with TransferWise

To illustrate how funds are sent using TransferWise, I’ll use the following example, of converting CAD to USD. As you can see, it’s a fairly straightforward, 6-step process.

- Signup With TransferWise. Registration is free, all you’ll need is an email address, or you can use an existing Google or Facebook account. You can sign up through the TransferWise website, or by using their mobile app.

- Set an amount that you wish to send. TransferWise will let you know upfront what the fee will be, and when your transfer will arrive.

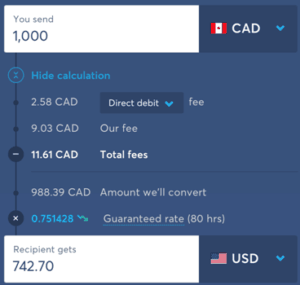

Here’s a snapshot of the calculated pricing of a $1,000 CAD transfer to USD. As you can see, the direct debit fee is only $2.58 CAD, and the Transferwise’s overall fee is $11.61 CAD. When you take into account the fact that you’re also saving money on the exchange rate (due to TransferWise using the mid-market rate), you’re going to save money with TransferWise vs. your bank.

- Provide your recipient’s bank account info. TransferWise does provide the option of reaching out to your recipient to collect their information directly.

- Confirm your identity. TransferWise is able to verify your ID online, and in some cases, that may require you providing photo ID, such as a driver’s license or passport.

- Fund your transfer. You can do this through direct debit (bank account), bill payment, wire transfer, or a debit/credit card. According to my calculations, you’ll incur the lowest fees via direct debit.

- Track your transfer. You’ve done everything you need to do. The rest is up to TransferWise, who will make sure your recipient gets their money. TransferWise allows you to track the progress of the transfer until it arrives at its destination.

I should point out, in my example above, the for sending payment via direct debit was $2.58 CAD Here’s a list of what the fee would be for the same transfer, using other payment methods. In this case, direct debit is by far the cheapest option.

- Debit card $20.09 CAD

- Credit card 29 CAD

- Domestic wire 50 CAD

- Bill payment 50 CAD

TransferWise Fees Explained

You may be wondering how TransferWise fees are structured, compared to other companies, or even your bank. When you send money, there are typically 3 components to a TransferWise transaction. Here’s how it breaks down:

Payment Fee

TransferWise charges a fee when you send money to your account for payment. You have up to 5 options, depending on the currency: bank debit, debit card, credit card, wire transfer, or bill payment. As you can see in the CAD to USD example I provided above, the bank debit method is the cheapest.

Transfer Fee

The transfer fee is expressed as a percentage of the amount of money being sent, but in most cases, it’s below 1%.

Real Exchange Rate

The third, and final component, is the currency exchange. With TransferWise, your funds will always be converted at the mid-market, or real exchange rate. This is the rate without the 1-4% spread, or hidden fee, which is always added on by your bank or broker. If you exchange funds on a regular basis, this is where you can realize enormous savings through TransferWise.

The TransferWise Borderless Account

The TransferWise Borderless account is a thing of beauty. If you are a freelancer or own a business with clients in several countries, TransferWise makes receiving payment in any number of foreign currencies a breeze. Here’s how it works. You start by opening your borderless account through the TransferWise app. From there, you can hold accounts in up to 30 foreign currencies, opening each one with a single click. You will be assigned a personal account number in each currency.

Anyone can then transfer money into an account, and you won’t pay any fees. As I mentioned, you can hold money in your account in over 30 currencies, and transfer currencies within seconds, at the real exchange rate (translation: far cheaper than your bank). TransferWise will charge a nominal fee for the exchange, which is displayed in an upfront, transparent fashion. Now, here’s where it gets interesting.

The TransferWise Debit Mastercard

You can now get a TransferWise debit Mastercard that allows you to spend the balance in your TransferWise Borderless account, anywhere Mastercard is accepted. What’s cool is that if you don’t have enough funds in the local currency, TransferWise will automatically pull available funds from the currency with the lowest exchange fee (providing you have funds available).

Features of the TransferWise Borderless Account:

- Hold up to 30 foreign currencies in your account

- No fees to receive payments into your account

- Free ATM withdrawals up to £200 monthly

- Nominal fee charged when you exchange between currencies (0.35-2%)

- Convert funds between currencies instantly, at the real exchange rate

- Debit card can be used worldwide, anywhere Mastercard is accepted.

With the addition of the TransferWise debit Mastercard, you may not even hold a U.S. dollar account through your primary bank. If you receive U.S. funds into your TransferWise account, you could simply hold the funds, and exchange or spend when necessary.

Is TransferWise Safe?

Anytime you’re dealing with a new company, especially one that’s going to be handling your money, you want to know that your funds, along with your personal information, is safe. You can be rest assured that this is the case with TransferWise. The company is registered with the financial regulating agencies in all of the major countries in which they do business.

For example, in Canada, TransferWise is registered with FINTRAC, which helps detect, prevent and deter prevention and money laundering as well as the financing of terrorist activities. All major financial institutions in Canada are required to report transactional information to FINTRAC.

Likewise, in the U.S., where TransferWise belongs to the Financial Crimes Enforcement Network (FinCEN). Not only that, but TransferWise deposits are held in financial institutions that are protected by the Federal Deposit Insurance Corporation (FDIC).

Transferwise Comparison (vs. PayPal/WorldRemit/RBC)

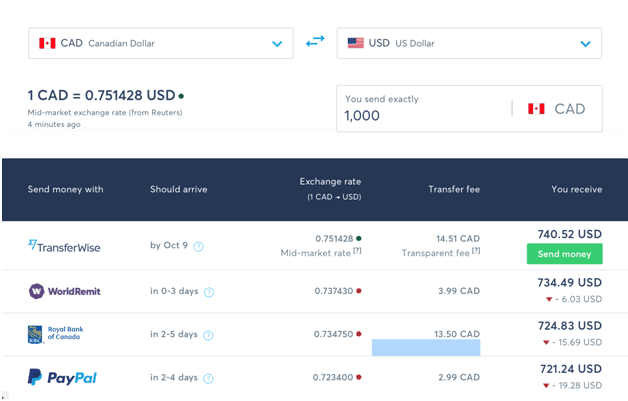

For a quick look at how TransferWise stacks up against the competition, I took a screenshot of a helpful comparison tool directly from the TransferWise website. This allows you to get a real-time look at the exchange rates and fees for a TransferWise transaction and compare it with the same transaction from a few key competitors, in this instance, Royal Bank, PayPal, and WorldRemit.

You’ll notice in this example that TransferWise is the only company offering the mid-market exchange rate. So, while their fee is actually the highest on the list, you would come out between $6-19 ahead with TransferWise vs. its three competitors. Keeping in mind, of course, that this comparison was done using TransferWise, and not a 3rd party app.

Transferwise Contact Info

If you’re looking for support through TransferWise, I recommend that you start at their Help Centre, located on their website. Here they have a tonne of articles designed to answer just about any question you might have. If you’ve gone through the FAQs, and you still have questions, TransferWise makes it easy for customers to reach them anytime, via email or phone. In Canada, telephone contact hours are between Monday-Friday, 9 AM-7 PM EST. Or, you can send them your question via email right on the website.

Final Thoughts on TransferWise Canada

Like most financial products and services, TransferWise isn’t for everyone. For example, if you only perform the occasional foreign exchange transaction, then it’s likely not worth the effort just to save a couple of bucks here and there.

However, if you buy and sell foreign currency with any regularity, either personally, or for business reasons, and you’re currently doing so through your primary bank, you really should consider moving that part of your business to a company like TransferWise. You’re simply leaving too much money on the table otherwise. And now, with the introduction of the TransferWise Debit Mastercard, making it easy to spend your foreign cash, that value proposition becomes even more pronounced.

TransferWise Review: A Better Way to Conduct Foreign Exchange? appeared first on MapleMoney.

The Best Places for Foreign Money Exchange

posted from http://feedproxy.google.com/~r/mrsjanuary/~3/UElOJrPLigE/

Planning a trip abroad? If you’re not careful, your budget can quickly be eaten up by high foreign exchange rates and fees. In this article, I’ll cover the many ways to exchange foreign currency, before or during your trip. In addition to showing you the cheapest ways to exchange money, I’ll let you know which currency exchange methods you should avoid.

Foreign Exchange – A Common Mistake

Many people think they can pick the best time to buy or sell foreign currency. As with investing, trying to time the markets is never a good idea. With any foreign exchange, the best approach is to plan ahead.

For example, if you’re planning a trip for which you’ll require a large amount of U.S. cash, and you’re not happy with the current exchange rate, you could decide to buy smaller amounts in regular intervals leading up to your trip. Trust me, trying to guess what direction the Canadian dollar is going to move, and when, is a fruitless effort.

Thankfully, regardless of what the Canadian dollar is trading at, you can always save money by finding better ways to buy and sell foreign currency. So, without further ado, here is my list of the best places to exchange money

No Foreign Exchange Fee Credit Cards

One of the easiest (and most convenient) ways to save on foreign exchange, is by using a credit card that waives the foreign exchange fee. For this, my top two choices are the Rogers World Elite Mastercard and the Scotiabank Passport Visa Infinite. Here’s a brief summary of what each card has to offer:

Rogers World Elite Mastercard

The Rogers World Elite is a no-fee, premium cashback credit card geared specifically for people who make a lot of purchases in a foreign currency ie. frequent travellers, or avid online shoppers. I should point out that this card doesn’t actually waive the 2.5% foreign exchange fee charged by most credit cards, instead, it pays a whopping 4% cashback on all purchases in a foreign currency.

This way, the cashback is enough to offset the 2.5% forex fee, while the cardholder benefits from a net 1.5% cashback. All without an annual fee. In addition, the several different types of insurance protection, including emergency medical, and trip cancellation and interruption coverage. I’ve included a list of features and benefits of the Rogers World Elite below, or for more information, you can check out my recent, in-depth review.

Features:

- Premium card, no annual fee

- $25 signup bonus

- 1.5% net cashback on all purchases in a foreign currency

- 2% cashback on Rogers purchases

- 1.75% cashback on all other spending

- 19.99% purchase interest / 22.99% cash advance interest

- Annual income threshold, $80,000/$150,000 household

- Private Lounge Access via Mastercard Airport Experiences

- Additional cards are free

Scotiabank Passport Visa Infinite

Unlike the Rogers World Elite, the Scotiabank Passport Visa Infinite actually waives the foreign exchange fee. Otherwise, it’s a premium Visa card that rewards customers when they spend on groceries, restaurants, entertainment, and transit. Another big perk to this card is the robust insurance coverage. It boasts more than 12 different types of travel and purchase protection. You can get more information on this foreign exchange friendly card in my detailed review of Scotiabank Rewards.

Features:

- Signup bonus of 30,000 Scotia Rewards Points ($300 value)

- 2 points earned for every dollar spent on groceries, restaurants, entertainment, transit

- 1 point earned on all other purchases

- Priority Pass access included, with 6 complimentary passes/year

- No foreign currency transaction fee

- $139 annual fee

- Minimum income requirement ($60,000/$100,000 household)

- 1 Free supplementary card ($50 value)

- 24/7 Concierge Service

- Includes 12 different types of travel and purchase insurance

Get a U.S. Dollar Credit Card

Another way to save on foreign exchange (when you’re travelling to the U.S.), is to avoid it altogether. Most Canadian banks offer a credit card that’s in U.S. dollars. This is different than a no foreign exchange fee card, in that no exchange actually occurs at the time of transaction.

To make a U.S. dollar card work, you’ll want to have a USD chequing account where you can accumulate U.S. dollars. When you need to pay off your credit card balance, you can transfer funds directly from your USD chequing account without any foreign exchange.

Of course, to get the money in your account, you’ll need to exchange CAD to USD at some point, but you have more control over when, and how you’ll exchange funds. A U.S. dollar credit card also helps in that it reduces the need to be carrying large amounts of U.S. cash when you’re across the border. Each of the Big Five banks offers a U.S. dollar credit card:

- TD U.S. Dollar Visa Card

- BMO U.S. Dollar Mastercard

- Scotiabank US Dollar Visa Card

- RBC U.S. Dollar Visa Gold

- CIBC U.S. Dollar Aventura Gold Visa Card

Use an Online Exchange

One of the cheapest ways to exchange money is through a dedicated online exchange. Because these companies buy and sell huge volumes of foreign currency in bulk, they are able to provide better rates, on average, than banks and credit unions. These companies are fully regulated and licensed to do business in Canada. Examples of online currencies would be KnightsbridgeFX and TransferWise. Here’s a more detailed look at Knightsbridge, which is headquartered in Toronto, and TransferWise.

Knightsbridge Foreign Exchange

KnightsbridgeFX provides online foreign exchange to Canadians at a better rate than what you would pay through your primary financial institution. In fact, they guarantee that they will beat any rate offered by your bank. According to Knightsbridge, you can book a forex transaction within minutes, and arrange for payment from your bank account. Knightsbridge promises same-day delivery, providing that you place your order prior to the daily cutoff.

One downside to Knightsbridge is that they have a minimum exchange threshold of $2,000, so you really can’t benefit from their service unless you’re exchanging lump sums of money.

TransferWise

TransferWise is a British company that makes it possible to send money around the world, at fees that are up to 8X less than what you would pay through your bank. When you open up a borderless account with TransferWise, you can quickly and easily send money to your recipient, in their local currency.

According to TransferWise, all that’s required is for you to deposit funds into your TW account, and exchange the funds into your selected currency at a rate that’s far lower than what your bank would charge (TransferWise does charge a small fee). Once the funds are converted, TransferWise will deposit into the recipient’s account on your behalf.

Norbert’s Gambit

Norbert’s Gambit is an investment strategy designed to avoid the spread that banks charge on CAD/USD foreign exchange transactions. If you’re an experienced investor who deals in larger volumes of currency exchange, Norbert’s Gambit could save you thousands of dollars over time.

Here’s the idea, in a nutshell. An investor buys shares of a stock or ETF on one exchange, then requests that their brokerage journal the shares over to the exact same listing in the foreign currency, at the market exchange rate, finally selling the shares in the currency that you want to end up with. In doing so, the only fees you should encounter would be the transaction fees of buying and selling the securities.

For more information, including how to execute it without paying any trading fees, here’s an article I wrote on Norbert’s Gambit.

Exchange Money Through Your Bank Branch

I suspect this is how most Canadians conduct foreign exchange, but it’s certainly not the cheapest way to go. On average, your bank branch is going to charge a higher rate on foreign exchange than the online methods that I described earlier (KnightsbridgeFx, TransferWise).

Here’s a tip, however. If you’re buying or selling U.S. dollars through your bank, open a USD chequing/savings account, and complete foreign exchange transactions on your own, via online banking. Most banks offer a slightly better exchange rate online because it’s not tying up expensive branch resources.

Exchange Money at an Airport or Hotel

I’m including this one in my list because it is certainly an option, but it’s not one I recommend. Many airports and hotels offer foreign exchange services, but they are incredibly expensive. You’ll often pay 10% or more in fees alone, over and above the exchange rate. Essentially, you’re paying for the convenience and the airport/hotel is betting that your options are limited. It’s a lot like buying food at a sporting event, or movie popcorn. That said, if you’re in a pinch, it is an option.

Foreign Exchange – Things to Avoid at all Costs

While there are many ways to exchange foreign currency, there are a few that you should avoid at all costs, because they’re either too expensive, a bit shady, or downright illegal. Of course, it goes without saying that whenever you travel abroad, be sure to take every precaution to protect yourself from theft, or fraud.

Dynamic Currency Conversion

When travelling abroad, many retailers will give you the option of paying in your home currency, meaning that they will do the exchange on their end, before you pay the bill. Never agree to this, as the exchange rates and fees they charge will always be higher than what you would pay using your own credit or debit card. When you’re presented with the option, always pay in the

Foreign Exchange Scams

Money exchange scams are becoming far too common, and it’s something you need to be aware of when you’re travelling. Always make sure you’re exchanging money through a reputable financial institution. Be wary of any individual who offers to exchange your money at a better rate than what the bank is offering. You could receive counterfeit funds in return, or have money stolen from you in the transfer process. You know what they say, “if it sounds too good to be true…”.

Foreign Currency Black Market

It should come as no surprise that there’s a thriving black market for foreign exchange. After all, anytime money can be made by circumventing the legal channels, there will be someone who’s willing to try. Taking part in a foreign currency black market is not only dangerous, but it could also result in your being caught, and arrested.

Do’s and Don’ts of Foreign Exchange

As you can see, there are many ways to exchange foreign currency. Unfortunately, only some will save you money. To summarize, I’ve created the following list of foreign exchange Do’s and Don’ts:

DO…

- apply for a credit card without foreign exchange fees.

- exchange lump sums through an online exchange ie. TransferWise

- use a U.S. dollar Visa to avoid exchanging altogether

- open a foreign currency bank account to accumulate/store funds

- consider Norbert’s Gambit (experience investors only)

DO NOT…

- time the market. No one knows what the value of the CDN dollar will be

- exchange money at an airport, or a hotel, unless it’s an emergency

- buy foreign currency at your bank branch

- use prepaid travel cards (high fees and service charges)

- allow retailers to do the currency conversion prior to making a purchase

- fall for a forex scam. Remember, if it’s too good to be true….

The Best Places for Foreign Money Exchange appeared first on MapleMoney.

Naomi Campbell Net Worth

posted from https://wealthygorilla.com/naomi-campbell-net-worth/

Introduction Naomi Campbell is an English model, actress, and businesswoman from London. Recruited at the age of 15, she established herself amongst the most recognizable and in-demand models of the late 1980s and the 1990s. She is considered to be one of the greatest models of all time. As of 2019, Naomi Campbell’s net […]

The post Naomi Campbell Net Worth appeared first on Wealthy Gorilla.

6 Ways to Balance a 9-5 and a Work From Home Job at the Same Time

For most people, when the clock strikes 5pm it’s quitting time. When you work a second job, it’s time to refocus and prepare for working for the rest of the night. The truth is, working one job doesn’t always cut it. Some households rely on a second income to make ends meet. When you have a part-time work from home job and a nine to five, it can be difficult to keep up with your responsibilities and find the right balance between fulfilling your commitment to both jobs without losing your mind.

Check out these simple tips for successfully balancing your regular job and your work from home gig:

1. Be Sure to Plan Your Week Ahead of Time

One of the best things you can do for yourself when you have a lot of commitments is to keep a close eye on your schedule. Unexpected events can easily pop up and ruin your productivity. What’s the solution? Try taking some time each weekend to focus on the things you must do in the upcoming week.

Perhaps there’s a company event or happy hour you want to attend on Friday night, and you’ll need to shift some of your work at home gigs to a weekend night or another day of the week. Also, once you’ve figured out how you are going to tackle your workload, you’ll be able to decline any invitations that pop out during the week that you didn’t plan for.

2. Determine Your Earning Goals

Whether you work as a remote customer service agent or you’re a freelance writer, the great thing about working from home is that most gigs offer great flexibility. Figure out how much extra money you need a month to run your household or pay off your debt and only work the hours you need to reach your goals. This will help free up more time for relaxing and spending time with family and friends.

3. Ditch the All Work And No Play Attitude

It’s easy to get stuck in grind mode especially when you’re fortunate enough to be able to earn money right from the comfort of your home. But you’ll need at least one full day off during the week to rest and recharge. When you have a work at home job, it’s easy to get caught up in working on a project when you have the day off. Whether it’s watching a Friends marathon or baking cookies, it’s important to find time to do the things that you love. It’s the only way you’ll keep your sanity.

4. Don’t Think About Work on Your Day Off

When you are juggling two jobs, your mind is most likely always centered around working, whether it’s worrying about expense reports or how much time it’s going to take you to finish a freelance project before you can start the next one. It’s easy to let your mind take over on your day off and there’s no magic cure to stop it from happening.

If you find that you’re really anxious about what you have to do and what you’ve actually managed to get done, consider making a list of all the tasks you have to do and check off the ones you’ve successfully completed. This reinforces in your mind that you’ve actually taken care of your responsibilities. Once you are assured that you have taken care of what needs to be done, try to relax your mind by doing something you love to do. Turn off your work phone and shut down your computer so that you don’t have constant access to work.

5. Come Up with Quick Fixes for Normal Life Tasks

When work takes over, it’s easy to forget about the normal things that help you lead a healthy and balanced life, like working out regularly or cooking dinner. When you’re working a second or third shift, doing such normality’s can become increasingly difficult. What should you do? Since staying active is important, you can find ways to get in a quick workout throughout your working day.

For instance, instead of taking the elevator to your floor at work, consider using the staircase or taking a walk during your lunch hour. Maybe you can squeeze in a quick workout with a thirty-minute workout video.

There’s also a number of ways you can simplify your cooking routine. You can meal prep on the weekends when you have some extra time. Preparing and freezing your meals for the entire week can make things much more efficient because all you have to do is pop your meals into the microwave when you get home from work.

Crock-pot meals are also fast and easy to make. All you have to do is throw a bunch of ingredients into the pot and it’ll be ready to eat by the time you make it home from your first job. Making triple batches of your family meals is also another great option because you eat off leftovers for days.

6. Learn to Say No to Time Wasters

When your second job is at home, it’s relatively easy to take on other unimportant tasks or veer from the weekly schedule you’ve created for yourself. A one-hour detour from your schedule may not seem like a big deal but when you realize how much work you’ve missed during that chunk of time, you’ll be angry at yourself. Also, detours can throw off your entire schedule and before you know it you haven’t tackled any of your projects. What’s the solution? Be committed to sticking to the things you have to prioritize and say no to time wasters who eat into your important tasks.

When you have your end goal in clear sight, you’ll be motivated to see both of your jobs through. Whether you’re working a work from home job to pay off a debt, save for a car and help start your own business, when you know what you’re doing it for, you’ll look at your jobs as a means to an end.